Blue Economy

India’s recent Interim Budget stressed on environment-friendly development through the promotion of ‘blue economy’.

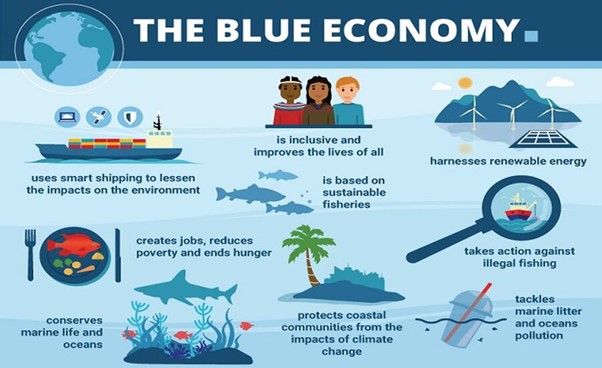

- Blue economy – It simply refer to economic activities related to the sea and the coasts with the element of sustainability in it.

- Definition

- European Commission – It refers to all economic activities related to oceans, seas, coasts and it covers a wide range of interlinked established and emerging sectors.

- World Bank – It is the sustainable use of ocean resources for economic growth, improved livelihoods, and jobs while preserving the health of ocean ecosystem.

- India’s Blue Economy – With long coastline, diversity in terms of fish & ocean produce, and multiple tourism opportunities, blue economy is highly significant.

- It is a subset of national economy which comprises of 2 components

- Ocean resources.

- Human-made economic infrastructure in marine, maritime, and onshore coastal zones.

- In 2022, a draft policy framework on India’s Blue Economy was 1st released.

Blue Economy 2.0

- Aim – To build resilience against the impacts of climate change while fostering sustainable growth in coastal regions.

- Restoration and adaptation measures – Protecting the health of the oceans while carrying out economic activities.

- Aquaculture – Farming of aquatic plants and animals.

- Mariculture – Rearing and harvesting marine creatures in salt water.

- Integrated & multi-sectoral approach – Harnessing collective efforts to achieve sustainable development goals in coastal areas.

Amrit Kaal Vision 2047 is the long-term blueprint for the Indian maritime blue economy for enhancing port, promoting sustainable practices and facilitating global collaboration.