G7 and EU announce price cap on Russian diesel

Context

The European Union (EU) has joined the United States and the United Kingdom in banning imports of Russian diesel and other refined oil products.

Price cap:

|

About the move:

- The price cap on Russian refined fuel.

- The ban on refined fuels — in particular, diesel with its wide industrial and domestic usage — has pushed the market into uncertainty amid historically low diesel stocks in Europe.

Background:

- The oil products embargo comes two months after a similar ban on Russian crude oil brought in by sea — both announced in June 2022 as part of the EU’s sixth sanctions package against Russia in response to Russia invasion of Ukraine.

- The crude oil embargo and the oil price cap which came into effect on December 5 passed off without any major disruption.

Significance of European Union and G7 Countries:

|

Impact on diesel prices:

- The sanction could lead to major disruptions in diesel-reliant industries such as transportation and agriculture, with fuel price rises further undermining the fight against inflation.

- The perceived disruption is already driving up diesel prices.

- While the situation has improved in recent months due to a mild winter, diesel stocks remained Low.

- An increase in shipping costs as supplies would now need to come from regions further afield, higher production costs in countries such as the

|

Demand-supply mismatches:

- The ban has left the EU with a void of about 600,000 barrels of diesel and related oil products per day,

- This gap that the EU intends to plug with increased supplies from the Middle East, Asia and the US.

- The large refineries such as the Al-Zour plant in Kuwait and the Jazan refinery in Saudi Arabia has increased its production and dependence over them by EU.

- Additionally, Germany has inked a deal with UAE’s Abu Dhabi National Oil Co that would see the oil firm provide 250,000 tons of diesel a month in 2023.

Impact on India:

- Increase in diesel exports: India’s diesel exports to Europe have soared since the invasion as refiners take advantage of low feedstock costs thanks to steeply discounted Russian crude and high diesel prices.

China’s move:

|

What would be the impact of the diesel price cap?

- The European Union (EU) and the Group of Seven (G7) industrialized countries, agreed to set a $100 (€91) per barrel price cap on Russian diesel and a $45 per barrel cap on discounted products like fuel oil.

- The price cap is meant to ensure that Russian diesel and other oil products can still be sold to third countries and prevent any massive spike in prices following the EU ban.

- The mechanism would allow European insurance and shipping firms to continue offering their services to shippers carrying Russian oil products to other regions as long as the fuel is purchased at or below an agreed cap level.

- The oil products price cap would have minimal impact on Russian refining crude runs and distillate exports.

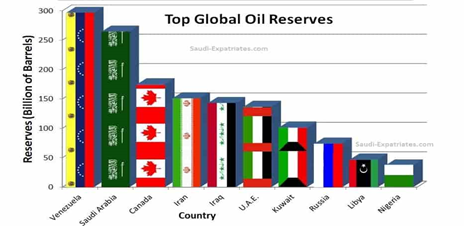

Major Oil reserves around the world: