India’s remittance inflows growth could slow to just 0.2% in 2023

Why in news?

- According to the World Bank’s latest Migration and Development Brief, India is expected to post a growth of just 0.2% in remittance inflows in 2023.

- It provides updates and analysis on global trends in migration and remittances.

- It also focuses on increasing the volume of remittances as a percentage of GDP, reducing remittance costs, and reducing recruitment costs.

- Slower growth in OECD and GCC economies, high base effect are few reasons behind this slowdown.

What’s in today’s article?

- Remittances

- News Summary

Remittances

- About

- RBI defines remittances as the transfer of money by an individual who is a resident of one country to an individual or entity in another country.

- Remittances generally involve migrant workers who send money back to their home countries to support their families or for other purposes.

- The RBI regulates remittance transactions and has put in place guidelines and regulations to govern the process.

- Authorized dealers, such as banks and other financial institutions, facilitate these remittance transactions in compliance with the RBI’s regulations.

- Importance

- In the aftermath of the Covid-19 pandemic, remittances are being viewed as a critical financial inflow.

- It is an important source of foreign exchange for several countries including those in South Asia.

- Remittances are highly complementary to government cash transfers and essential to households during times of need.

- In India, remittances represented only 3.3% of GDP in 2022.

News Summary: India’s remittance inflows growth could slow to just 0.2% in 2023

Why are remittances expected to grow at a slower pace in 2023?

- Slower growth in OECD economies

- Slower growth in OECD economies — especially in the high-tech sector in the United States has affected the demand for information technology (IT) workers.

- OECD is an intergovernmental organisation with 38 member countries.

- It was established in 1961 to stimulate economic progress and world trade.

- The majority of OECD Members are ranked as very high in the Human Development Index, and are regarded as developed countries.

- It could lead to a diversion of formal remittances toward informal money transfer channels.

- Slower growth in OECD economies — especially in the high-tech sector in the United States has affected the demand for information technology (IT) workers.

- Lower demand for migrants in the Gulf Cooperation Council (GCC) countries

- GCC is a grouping of six Arab nations located around the Arabian Gulf, where declining oil prices have dented growth.

- 6 countries are – Bahrain; Kuwait; Oman; Qatar; Saudi Arabia; UAE.

- GCC is a grouping of six Arab nations located around the Arabian Gulf, where declining oil prices have dented growth.

- High Base effect

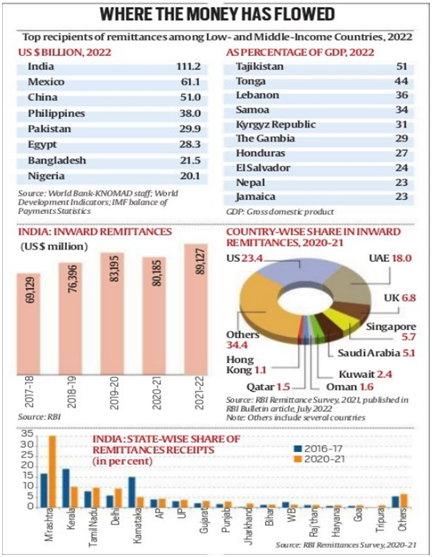

- In 2022, India registered a growth of more than 24% to reach a record-high $111 billion in remittances in 2022.

- The high base in 2022 will significantly affect the growth rate of remittances for India in 2023.

What are the top sources of remittances for India?

- Almost 36% of India’s remittances are from the high-skilled and largely high-tech Indian migrants in three high-income destinations — US, United Kingdom, and Singapore.

- The post-pandemic recovery led to a tight labour market in these regions, and wage hikes boosted remittances.

- Remittance inflows from the GCC countries account for about 28% of India’s total remittance inflows.

- High energy prices favoured employment and incomes of the less-skilled Indian migrants in the GCC countries.

- At the same time, the GCC governments’ special measures to curb food price inflation shielded migrants’ remitting potential.

What was the trend for remittances in 2022?

- In 2022, India posted more than 24% growth in its inward remittances to reach $111 billion, higher than the World Bank’s earlier estimate of $100 billion.

- India represented 63% of South Asia’s remittance flows.

- The top five recipient countries for remittances in 2022 were India ($111 billion), followed by Mexico ($61 billion), China ($51 billion), Philippines ($38 billion), and Pakistan ($30 billion).

- Remittances were supported by:

- oil surge in member countries of the GCC, which increased migrants’ incomes;

- large money transfers from the Russian Federation to countries in Central Asia; and

- the strong labour market in the US and the OECD countries.