DAILY CURRENT AFFAIRS BITS

TOPIC – 1 – Panna Tiger Reserve (PTR)

Recently, as part of the Ken-Betwa Link Project (KBLP), a comprehensive Integrated Landscape Management Plan (ILMP) has been prepared for the conservation of wildlife and biodiversity in the Panna Tiger Reserve (PTR) & surrounding areas.

Why in news?

- To ensure systematic and time-bound implementation of the Greater Panna Landscape Management plan, the Greater Panna Landscape Council (GPLC) has been constituted under the chairmanship of the Chief Secretary, Govt. of Madhya Pradesh with members from all the stakeholders.

Key facts about the Panna Tiger Reserve

- Panna Tiger Reserve is a critical tiger habitat located in Vindhya Hill in northern Madhya Pradesh.

- The dominating vegetation type is dry deciduous forest interspread with grassland

- In the north, it is surrounded by teak forest & in the east, it is surrounded by Teak-Kardhai mixed forest.

- The North East-South West, running Vindhya Hill ranges link the eastern and western populations of wild animals.

- Fauna: Leopard, Wild dog, wolf, Hyaena, Sloth bear etc.

What is Ken-Betwa Link Project?

- Under this, the transfer of excess water from the River Ken to the Betwa basin through the use of a concrete canal is proposed.

- It is the first project under the National Perspective Plan for the interlinking of rivers.

- It aims to provide irrigation to the Bundelkhand region, which is one of the worst drought-affected areas in India.

- A Tripartite Memorandum of Understanding was signed between the Centre and the governments of UP and MP for the project.

- Implementing Agency: A Special Purpose Vehicle (SPV) called Ken-Betwa Link Project Authority (KBLPA) will be set up to implement the project.

TOPIC – 2 – Press Council of India (PCI)

The Press Council of India (PCI) recently issued an advisory to the print media on ‘paid news’.

About the Press Council of India (PCI):

- The PCI was first set up in 1966 by the parliament on the recommendations of the First Press Commission under the chairmanship of Justice J.R Mudholkar.

- The present council functions under the Press Council Act 1978.

- It is a statutory, quasi-judicial body that acts as a watchdog of the press in India.

Composition:

-

- It consists of a Chairman and 28 other members.

- The Chairman is nominated by a committee consisting of Chairman of Rajya Sabha, the Speaker of Lok Sabha, and one representative of the council

- The Chairman, by convention, has been a retired judge of the Supreme Court.

- The term of the Chairman and the members of the Council is 3 years.

- Primary Function: To check the media practice and to keep an eye on the freedom of the press.

Other Functions:

-

- Helping newspapers to maintain their independence;

- Building up a code of conduct for journalists and newspapers according to high professional standards;

- Reviewing any development which is likely to restrict the supply and dissemination of news of public interest and importance;

- Reviewing such cases where assistance has been received by any newspaper or news agency in India from foreign sources, as referred to it by the Central Government;

- Providing facilities for the proper education and training of persons in the profession of journalism;

- Studying developments that may lead towards monopoly or concentration of ownership of newspapers and suggest remedies;

Powers:

-

- It adjudicates the complaints either against the Press for violation of journalistic ethics or by the Press for interference with its freedom.

- The council shall have the same powers throughout India as are vested in a Civil court while trying a suit under the Code of Civil Procedure, 1908.

- Every inquiry held by the council shall be deemed to be a judicial proceeding under sections 193 and 228 of the Indian Penal Code.

- The decision of the council is final and can not be challenged in any court of law.

TOPIC – 3 – Foreign Contribution Regulation Act

Recently, the Central government of India suspended the Foreign Contribution Regulation Act (FCRA) licence of the Centre for Policy Research (CPR).

About Foreign Contribution Regulation Act:

- This act was enacted during the Emergency in 1976 amid apprehensions that foreign powers were interfering in India’s affairs by pumping money into the country through independent organisations.

- The FCRA requires every person or NGO seeking to receive foreign donations to be

- Registered under the Act

- To open a bank account for the receipt of foreign funds in the State Bank of India, Delhi.

- To utilise those funds only for the purpose for which they have been received and as stipulated in the Act.

Eligibility criteria for the registration

- These registrations are granted to individuals or associations that have definite cultural, economic, educational, religious, and social programmes.

- The applicant should not be fictitious or benami; and should not have been prosecuted or convicted for indulging in activities aimed at conversion through inducement or force, either directly or indirectly, from one religious faith to another.

- Once granted, FCRA registration is valid for five years. NGOs are expected to apply for renewal within six months of the date of expiry of registration.

- Registration can be cancelled if an inquiry finds a false statement in the application

- Once the registration of an NGO is cancelled, it is not eligible for re-registration for three years.

- The ministry also has the power to suspend an NGO’s registration for 180 days pending inquiry and can freeze its funds.

- All orders of the government can be challenged in the High Court.

TOPIC – 4 -Erythritol

New research by Cleveland Clinic, published in Nature Medicine, has shown that Erythritol, a popular artificial sweetener, is associated with an increased risk of heart attack and stroke.

Why in news?

- The researchers have pointed out the following issues in the report

- Long-term use of this particular artificial sweetener is associated with an increased risk of heart attack and stroke.

- Erythritol made platelets easier to activate and form a clot.

- After ingestion, erythritol is poorly metabolised by the body. Instead, it goes into the bloodstream and leaves the body mainly through urine.

- The human body creates low amounts of erythritol naturally, so any additional consumption can accumulate.

What is Erythritol?

- Erythritol is a popular artificial sweetener that is widely available throughout the world.

- It is an organic compound – a naturally occurring, four-carbon sugar alcohol (or polyol).

- It is used as a food additive and sugar substitute.

- Erythritol is 60–70% as sweet as sucrose (table sugar).

- However, it is almost completely noncaloric and does not affect blood sugar or cause tooth decay.

- Synthesis: It is synthesized from corn using enzymes and fermentation.

TOPIC – 5 – SWAYATT Initiative

Recently, a function was held to commemorate the success of “SWAYATT”, an initiative that was first launched in February 2019.

About SWAYATT Initiative:

- It is an initiative to promote Start-ups, Women and Youth Advantage Through eTransactions on Government eMarketplace (GeM).

- Aim: To promote the inclusion of various categories of sellers and service providers on the portal by taking proactive steps to facilitate their training and registration, develop women’s entrepreneurship, and encourage the participation of the MSME sector and startups in public procurement.

What is Government e-Marketplace (GeM)

- GeM is an Online Market platform that was set up in 2016 to facilitate the procurement of goods and services by government ministries, departments, public sector undertakings (PSU) etc.

- It has been envisaged as the National Procurement Portal of India.

- This portal was developed by the Directorate General of Supplies and Disposals (Ministry of Commerce and Industry) with technical support from the National e-governance Division (Ministry of Electronic and Information Technology).

- GeM is a completely paperless, cashless and system-driven e-marketplace that enables procurement of common-use goods and services with minimal human interface.

Recently, on the occasion of “National Science Day”, Union Minister of State (Independent Charge) Science & Technology launched the VAIBHAV Fellowship scheme for the Indian Diaspora abroad.

About the VAIBHAV Fellowship scheme:

- The fellowship offers Non-Resident Indian (NRI) researchers an opportunity to work for a minimum of one month to a maximum of two months a year with a research institution or an academic institution in India.

- Duration: Three years with the government offering the researchers an amount of up to Rs 37 lakh for the entire period.

- Aim: Improving the research ecosystem of India’s Higher Educational Institutions by facilitating academic and research collaborations between Indian Institutions and the best institutions in the world.

- This is done through the mobility of faculty/researchers from overseas institutions to India.

- Eligibility: Researchers from institutions featuring in the top 500 QS World University Rankings will be eligible for the fellowship.

- The applicant should be a Non-Resident Indian (NRI), Person of Indian Origin (PIO) or Overseas Citizen of India (OCI) and she or he must have obtained Ph.D/M.D/M.S degree from a recognized University.

- Significance: The best of Diaspora minds will collaborate with domestic Minds to deliver world-class projects and products.

The Indian Air Force (IAF) is participating in Exercise Shinyuu Maitri with the Japan Air Self Defence Force (JASDF).

About Exercise Shinyuu Maitri :

- It is a bilateral military exercise between Indian Air Force (IAF) and Japan Air Self Defence Force (JASDF).

- The exercise is being organized on the sidelines of the Indo-Japan Joint Army Exercise, Dharma Guardian.

- The IAF contingent is participating in the exercise with one C-17 Globemaster III

- The first phase of the exercise consists of discussions on transport operations and tactical manoeuvering, followed by the second phase of flying drills by IAF’s C-17 and JASDF C-2 transport aircraft.

- The exercise will enhance mutual understanding and interoperability between the two air forces.

The Union Cabinet recently approved the procurement of 70 HTT-40 basic trainer aircraft costing Rs 6,828 crore for the Indian Air Force.

About HTT-40 trainer aircraft:

- The Hindustan Turbo Trainer-40 (HTT-40) is a basic trainer aircraft (BTA).

- It is designed and developed by Hindustan Aeronautics Limited (HAL).

Features:

-

- It is a turboprop aircraft designed to have good low-speed handling for better training effectiveness.

- It has a maximum take-off weight of 2.8 tonnes.

- It can achieve a top speed of 450 Km/hr and a maximum range of 1,000km.

- The fully aerobatic tandem seat HTT-40 has an air-conditioned cockpit, modern avionics with multifunction displays, hot refueling, and zero-zero (zero speed and zero altitude) ejection seats.

- The aircraft will meet the shortage of BTAs for the training of newly inducted pilots of the Indian Air Force (IAF).

- It will be used for basic flight training, aerobatics, instrument flying, and close formation flights, in addition to undertaking secondary missions such as navigation and night flying flights.

What is a turboprop aircraft?

- A turboprop aircraft uses a turbo-prop engine rather than a piston-powered engine or a jet engine.

- They have one or more gas-turbine engines connected to a gearbox that turns the propeller(s) to move the aircraft on the ground and through the air.

- Turboprop aircraft have lower operating costs than jets because they burn less fuel, but they are also slower than jets.

- They are massive megalithic stone-carved human-shaped statues found at Easter Island.

- They are famous for their carved heads and “Pukao,” a hat-like covering made from a soft red stone.

- They were built inapproximately 1400 – 1650 A.D. by the natives of this island known as Rapa Nui.

- There are around 1000 Moai statues which are made up of volcanic tuff, the tallest of them being 33 feet.

- On average, they weigh between 3 to 5 tons, but the heaviest ones can weigh up to 80.

- The tools used for carving the moai statues are called toki, and are simple handheld chisels.

What do moais represent?

-

- They were built to honor chieftains or other important people who had passed away.

- They were placed on rectangular stone platforms called ahu, which are tombs for the people that the statues represented.

- The moais were intentionally made with different characteristics since they were intended to keep the appearance of the person they represented.

Easter Island:

- Easter Island, also called Rapa Nui, is a remote Chilean territory located in the Pacific Ocean, roughly 2,200 miles from mainland Chile.

- It is one of the most remote inhabited places in the world.

- Much of the island, which is home to some 8,000 residents, is protected as a national park and a UNESCO World Heritage site.

- The Reserve Bank of India (RBI) recently proposed to move the banking system to an expected credit loss-based provisioning approach from an “incurred loss” approach.

What is a loan-loss provision?

- The RBI defines a loan loss provision as an expense that banks set aside for defaulted loans.

- Banks set aside a portion of the expected loan repayments from all loans in their portfolio to cover the losses either completely or partially.

- In the event of a loss, instead of taking a loss in its cash flows, the bank can use its loan loss reserves to cover the loss.

- The level of loan loss provision is determined based on the level expected to protect the safety and soundness of the bank.

What is the Expected Credit Loss (ECL) regime?

- Under this practice, a bank is required to estimate expected credit losses based on forward-looking estimations rather than wait for credit losses to be actually incurred before making corresponding loss provisions.

- As per the proposed framework, banks will need to classify financial assets (primarily loans) as Stage 1, 2, or 3, depending on their credit risk profile, with Stage 2 and 3 loans having higher provisions based on the historical credit loss patterns observed by banks.

- This will be in contrast to the existing approach of incurred loss provisioning, whereby step-up provisions are made based on the time the account has remained in the Non-Performing Asser (NPA) category.

Benefits of the ECL regime:

-

- It will result in excess provisions as compared to a shortfall in provisions, as seen in the incurred loss approach.

- It will further enhance the resilience of the banking system in line with globally accepted norms.

What is the problem with the incurred loss-based approach?

- It requires banks to provide for losses that have already occurred or been incurred.

- The delay in recognizing loan losses resulted in banks having to make higher levels of provisions which affected the bank’s capital. This affected banks’ resilience and posed systemic risks.

- The delays in recognizing loan losses overstated the income generated by the banks, which, coupled with dividend payouts, impacted their capital base.

The Union Ministry of Home Affairs (MHA) has decided to start the process of seeking the states’ comments on the Punchhi Commission’s report on Centre-state relations.

What is the Punchhi Commission?

- The Punchhi Commission was constituted by the Union Government in April 2007 under the chairmanship of former Chief Justice of India (CJI) Madan Mohan Punchhi.

- The Commission examined and reviewed how the existing arrangements between the Union and States were functioning, as well as various court rulings regarding the powers, duties, and responsibilities in all areas, including legislative relations, administrative relations, the role of governors, emergency provisions and others.

- The Commission presented its seven-volume report to the government in March 2010.

- The Inter-State Council’s (ISC) Standing Committee considered the suggestions of the Punchhi panel at its meetings in April 2017, November 2017, and May 2018.

What are the Key Recommendations of Punchhi Commission?

National Integration Council:

-

- It recommended the creation of a superseding structure for matters relating to internal security (like the Homeland Security Department in the United States). This structure could be known as the ‘National Integration Council’.

Amendment to Article 355 and Article 356:

-

- It advised that Article 355 and Article 356 of the Constitution should be amended.

- Article 355 talks about the duty of the Centre to protect the state against any external aggression and Article 356 talks about the implementation of President’s rule in case of failure of the machinery of the state.

- The recommendation seeks to protect States’ interest by curbing the centre’s misuse of powers.

- It advised that Article 355 and Article 356 of the Constitution should be amended.

Subjects in the Concurrent List:

-

- The Commission recommended that the States should be consulted through the inter-state council before bills are introduced on matters that fall in the concurrent list.

- A concurrent list is one of the three lists; in this, the matters on which both State and Centre governments can formulate laws are mentioned.

- The Commission recommended that the States should be consulted through the inter-state council before bills are introduced on matters that fall in the concurrent list.

Appointment and Removal of Governors:

-

- The Governor should stay away from active politics (even at a local level) for at least two years prior to his appointment.

- There should be a say of the state’s Chief minister while making the Governor’s appointment.

- A committee should be formed that is entrusted with the task of appointment of governors. This committee may comprise the Prime Minister, the Home Minister, the Lok Sabha’s speaker and the concerned Chief Minister of the State.

- The term of appointment should be five years.

- Governor could only be removed via a resolution by the State Legislature.

Union’s Power of Making Treaties:

-

- The treaty-making power of the union should be regulated with respect to treaties formulated in concern with the matters present in the State list.

- This way, the states will get more representation in their internal affairs.

- The Commission identified that the states need to be more involved in such kinds of treaties that are formulated in reference to their issues. This will ensure a peaceful co-existence between the different levels of the government.

Appointment of Chief Ministers:

-

- Clear guidelines should be made with regard to the appointment of chief ministers so that the governor’s discretionary powers are limited in this aspect.

- A pre-poll alliance is to be considered as a single political party.

- The order of precedence while the State government is being formed should be the following:

- The group/alliance with the largest pre-poll alliance with the highest number.

- The single largest party with support from others.

- The post-poll alliance with a few parties joining the government.

- The post-poll alliance with a few parties joining the government and remaining including independents giving outside support.

TOPIC – 12 – Earth’s 5th Layer Confirmed

Scientists, in a new study, have confirmed the existence of a 5th new layer – the innermost inner core (apart from the 4 layers: crust, mantle, outer liquid and inner solid core) with a radius of around 650 Km (inner core radius (whole) – 1,221 km).

About :

- This 5th layer is made of the same material as the inner core (iron and nickel) and the main difference between the two is the way the atoms are arranged to form a solid. This layer could have solidified and grown in a different direction than the rest of the inner core. The idea that the Earth could hold a 5thlayer was proposed in 2002.

- Scientists rely on seismic waves to study earth’s interiors. These waves behave differently as they pass through diverse materials (e.g. – travel slower while passing through hot materials).

- According to the analysis done, the innermost inner core slows down the seismic waves at a point between the rotation axis (from pole to pole) and the equatorial plane (perpendicular to the poles). In contrast, the outer shell of the inner core slows down the waves only in the equatorial plane.

TOPIC – 13 – Social Stock Exchange (SSE)

Why in news?

The National Stock Exchange of India received the final approval from the markets regulator Securities and Exchange Board of India (SEBI) to set up a Social Stock Exchange (SSE).

What is a Social Stock Exchange?

- The SSE would function as a separate segment within the existing stock exchange and help social enterprises raise funds from the public through its mechanism.

- It would serve as a medium for enterprises to seek finance for their social initiatives, acquire visibility and provide increased transparency about fund mobilisation and utilisation.

- Retail investors can only invest in securities offered by for-profit social enterprises (FPSEs) under the Main Board.

- In all other cases, only institutional investors and non-institutional investors can invest in securities issued by SEs.

What about eligibility?

- Social Intent – Any non-profit organisation (NPO) or FPSEs that establishes the primacy of social intent would be recognised as a social enterprise.

- Those recognised will make it eligible to be registered on the SSE.

- Dependent on Corporates – NPOs that are dependent on corporates for more than 50% of its funding are considered ineligible.

How do NPOs raise money?

- Zero Coupon Zero Principal (ZCZP) – NPOs can raise money either through issuance of ZCZP instruments from private placement or public issue, or donations from mutual funds.

- ZCZP bonds differ from conventional bonds in the sense that it entails zero coupon and no principal payment at maturity.

- The minimum issue size is presently prescribed as Rs 1 crore and minimum application size for subscription at Rs 2 lakhs for ZCZP issuance.

- The NPO may choose to register on the SSE and not raise funds through it but via other means, however, they would have to make necessary disclosures about the same.

What about on completion of projects?

- Development Impact Bonds – It is another structured finance product available for NPOs.

- Upon the completion of a project and having delivered on pre-agreed social metrics at pre-agreed costs/rates, a grant is made to the NPO.

- The donor who makes the grant upon achieving the social metrics would be referred to as Outcome Funders.

- Since the payment above is on post facto basis, the NPOs would have to also raise money to finance their operations.

- This is done by a Risk Funder who alongside enabling the financing of operations on a pre-payment basis, also bears the associated risk with non-delivery of social metrics.

How do FPOs raise money?

- For-Profit Enterprises (FPEs) need not register with social stock exchanges before it raises funds through SSE.

- However, it must comply with all provisions of the ICDR Regulations when raising through the SSE.

- It can raise money through issue of equity shares to an Alternative Investment Fund including Social Impact Fund or issue of debt instruments.

What disclosures need to be made?

- Annual impact report – SEBI’s regulations state that a social enterprise should submit an annual impact report in a prescribed format.

- The report must be audited by a social audit firm and has to be submitted within 90 days from the end of the financial year.

- Money raised – Listed NPOs, on a quarterly basis, are specifically required to furnish details about the money they have raised category-wise.

TOPIC – 14 – Cotton: Crying out for change

Why in news?

Cotton farmers in Northern India suffered heavy losses in the last kharif season.

What are the reasons for less cotton productivity?

- The cotton productivity estimate was reported to be at its lowest in the North zone comprising of Punjab, Haryana and Rajasthan.

- North zone cotton, which recorded the highest cotton yield in 2019-20 is now down by over 30%.

- Reasons – The losses are mounting due to the rising cost of cultivation, climate induced change in pest dynamics and rampant sale of unauthorised seeds and unchecked pesticides sprays.

- Health & Environment – The boom and tractor mounted sprayers are back with unimaginable consequences on human health and environment.

- Climate Change – Climate change induced weather aberration, widespread infestation of boll devouring pink bollworm, new tobacco streak virus disease and boll rot have recently threatened cotton farmers.

- Crop diseases – The white fly transmitted severe cotton leaf curl virus and sudden outbreak of para wilt have worsened the situation for North zone farmers.

- Lack of infrastructure – The cotton sector seems to be dogged by some serious structural deficiencies.

What is the impact of low cotton productivity?

- Imbalance in demand-supply – Cotton productivity, has continuously been decelerating, causing imbalance in demand-supply of cotton and uncertainty in the cotton textile industry.

- Increase in imports – This dip in cotton production has forced the textile industry to rely on imports, which increased to 35.3 lakh bales worth ₹8,339.26 crore in 2018-19.

- The relaxation in import duty structure would hit the balance of trade in cotton, which remained favourable over the last two decades.

- Decrease in exports – On the other hand, cotton exports, which peaked in 2014-15, have since declined.

What are the strategies used to overcome the challenges?

- HDPS – The cropping system of cotton must gradually undergo a systematic change to high density planting system (HDPS).

The HDPS is a new cropping system of accommodating more plants per unit area supported by technological inputs for weed management, defoliation and mechanical picking.

- Dibbling – Our farmers practice dibbling based sowing of bushy-type, long duration hybrid cotton seeds at a large spacing accommodating fewer plants per acre.

- The farmers harvest seed cotton 3-4 times in a season spanning 180 to 280 days in different cotton growing zones.

- Hybrid Cotton – New erect type hybrid cotton genotypes have been introduced to optimise plant population.

- However, but this forms just one-fourth of what is being practiced under HDPS in countries with high cotton yield.

What is the way forward?

- Policies – The government-led policy paradigm on cotton must give way to progressive evidence-based policies on pricing of seeds and safeguarding intellectual property.

- Intellectual Property Rights – Enforcement of IPR on new varieties suitable for HDPS while ensuring farmers’ rights must be strengthened to attract investment in R&D and breeding of high-density suitable genotypes.

- Transfer of Seeds – Exchange of pre-breeding germplasm under material transfer agreement (MTA) and access and benefit sharing (ABS) mechanism for cross border material transfer must be prioritised.

- Price Control – The price control of cotton seeds under the Cotton Seed Price (Control) Order, 2015 has discouraged breeding activities and stalled introduction of much needed technologies for weed management.

- This has also fuelled the growth of illegal market for herbicide tolerant (HT) cotton.

- The term ‘whip’ is derived from the old British practice of “whipping in” lawmakers to follow the party line.

- The ‘office of whip’ is not mentioned or defined in the Constitution.

- The ‘office of whip’ is a Parliamentary convention.

- In parliamentary parlance, a whip may refer to both

- A written order to members of a party in the House to abide by a certain direction, and

- To a designated official of the party who is authorised to issue such a direction.

- Position – In India, all parties can issue whips to their members.

- Parties appoint a senior member from among their House contingents to issue whips.

- This member is called a chief whip, and he/ she is assisted by additional whips.

- Function – A whip may require that party members be present in the House for an important vote, or that they vote only in a particular way.

- Degree of importance of Whip – Whips can be of varying degrees of seriousness and can be inferred from the number of times an order is underlined.

| A one-line whip

Underlined once |

Usually issued to inform party members of a vote. |

| Allows them to abstain in case they decide not to follow the party line. | |

| A two-line whip

Underlined Twice |

Directs them to be present during the vote. |

| Abstention from voting invites more scrutiny from party. | |

| A three-line whip

Underlined Thrice |

Strongest whip.

Employed on important occasions such as the second reading of a Bill or a no-confidence motion. |

| Places an obligation on members to toe the party line. |

- Penalty – The penalty for defying a whip varies from country to country.

- In India – Rebelling against a three-line whip can put the membership of the House at risk.

- The anti-defection law allows the Speaker/ Chairperson to disqualify such a member.

- Exception – When more than a third of legislators vote against a directive, effectively splitting the party.

- The United Kingdom – An MP can lose membership of the party, but can keep their House seat as an Independent.

- The US – More freedom to House members. The party whip’s role is to gauge and persuade them to vote according to the party line.

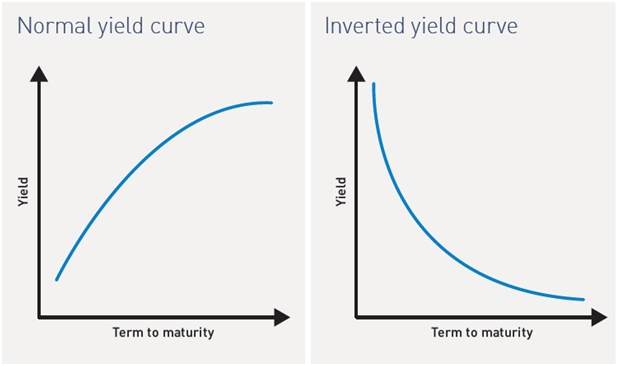

- The yield curve represents the yield or interest rates of similar bonds across various tenors (maturity).

- Usually, the yield rises with an increase in the tenor of bonds.

- Yield Curve Inversion – It occurs when short-term bonds have higher yields than similar profile long-term bonds.

- It occurs under 2 situation.

- When the yield of longer-term bonds dips below that of medium-term bonds or

- The yield of medium-term bonds falls below that of short-term bonds.

- Indicates – Yield curve inversion could denote an impending economic recession or slowdown.

- However, this phenomenon may be short-lived once the demand for medium papers from banks increases.

- RBI Measures – RBI tries to ensure that the yield curve slopes upwards as the tenor of G-Secs increases by increasing the demand for Treasury bills.

TOPIC – 17 – Chhatrapati Sambhaji Nagar

Aurangabad in Maharashtra recently rechristened Chhatrapati Sambhaji Nagar.

About :

- Aurangabad’s history incorporates the Sultanate, Mughals and the Marathas, and goes back further in time.

- Ajanta-Ellora – The famous Ajanta-Ellora caves is in Aurangabad.

- Ajanta – 30 rock-cut Buddhist monuments from second century BC.

- Ellora – The largest rock-cut Hindu temple and its hundred caves dating back to the Rashtrakuta and Yadava dynasties.

- The Ajanta-Ellora caves are UNESCO World Heritage Sites.

- Sultanate – Mohammed Bin Tughlaq, a Sultan, decided to shift his capital to safer Daulatabad or Deogir but failed to do so.

- The fort in Daulatabad was the capital of the Yadava dynasty till the 14th century, and later became a part of the Ahmednagar Sultanate.

- Mughals – The tomb of the Mughal emperor Aurangzeb lies in Aurangabad.

- Aurangzeb’s wife Dilras Banu Begam’s burial mausoleum, known as ‘Bibi ka Maqbara’ also lies here.

- It was built by Aurangzeb and known as ‘Taj of Deccan’.

- Marathas – Aurangabad was rechristened after Sambaji.

- Sambhaji was Maratha ruler Chhatrapati Shivaji’s son.

- The city also hosts the well-known Shivaji Museum

TOPIC – 18 – BIMSTEC Energy Centre

India hosted the first meeting of the Governing Board of BIMSTEC Energy Centre (BEC) in Bengaluru.

About :

- BIMSTEC Energy Centre (BEC) is one of the 2 centres of BIMSTEC.

- The other being – BIMSTEC Centre on Weather and Climate.

- The establishment of BIMSTEC Energy Centre (BEC) was envisaged during the First BIMSTEC Energy Ministerial Meeting held in New Delhi in 2005.

- Aim – To coordinate, facilitate, and strengthen cooperation in the energy sector in the BIMSTEC region by promoting experience sharing and capacity building.

- Meeting Highlights – There was active participation from all 7 BIMSTEC countries viz. Bangladesh, Bhutan, India, Myanmar, Nepal, Sri Lanka and Thailand.

- India made a presentation on establishing the BIMSTEC Energy Centre (BEC) in India in the premises of the Central Power Research Institute (CPRI), Bengaluru.

- Considering the current energy scenario in BIMSTEC region, the Meeting recommended to add the additional following areas under the specialized Wings of BEC:

- Cyber Security,

- Green Hydrogen

- Energy Transition

TOPIC – 19 – Fugitive economic offenders

Context

India has called upon G20 countries to adopt multilateral action for faster extradition of ‘fugitive economic offenders’.

About

- India has urged for action against fugitive offenders during the first Anti-corruption working group meeting held in Gurugram.

- Economic offences have been a problem faced by many, especially when the offenders flee from the jurisdiction of the country.

- India has put in place specialised legislation in this regard, in the form of Fugitive Economic Offenders Act, 2018.

Who are ‘fugitive economic offender’ (FEO)?

- FEO is defined as an individual against whom a warrant of arrest in relation to scheduled offence has been issued by any court in India and the value of the offence is at least Rs. 100 crore.

- The offender has left the country so as to avoid criminal prosecution; and refuses to return to face criminal prosecution.

Fugitive economic offenders act, 2018

- About: It aims to seize the property of economic offenders who have fled the nation to avoid being prosecuted or who refuse to come back to face charges.

- Declaration of FEO: A special court (established under the PMLA, 2002) may designate someone as a fugitive economic offender after hearing the application.

- It has the authority to seize any property, whether it is located in India or outside, including Benami properties and proceeds of crime.

- Upon confiscation, the central government will become the sole owner of the property and have all rights and titles (such as any charges on the property).

- Bar on Filing or Defending Civil Claims: The Act allows any civil court or tribunal to prohibit a declared fugitive economic offenderfrom filing or defending any civil claim.

About G20:

- The Group of Twenty, or G20, is an intergovernmental organization made up of the European Union (EU) and 19 other nations.

- The late 1990s financial crisis, which mostly affected East Asia and Southeast Asia, served as the backdrop for the formation of the G20 in 1999.

- Members: Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Republic of Korea, Mexico, Russia, Saudi Arabia, South Africa, Turkey, the United Kingdom, the United States and the EU.

- Together, the G20 countries include:

- 60 percent of the world’s population,

- 80 percent of global GDP, and

- 75 percent of global trade.

- The G20’s presidency is rotated annually among its members. The G20 “Troika” is made up of the current G20 President, the outgoing and incoming presidents, and they work to maintain the agenda.

Objectives:

-

- Policy coordination between its members in order to achieve global economic stability, sustainable growth;

- To promote financial regulations that reduce risks and prevent future financial crises; and

- To create a new international financial architecture.

DAILY EDITORIAL BITS

EDITORIAL – 1- E-Pharmacies: On regulating online sale of drugs in India

Why in News?

- Recently, the Union Ministry of Health and Family Welfare (MoH&FW) pulled up at least twenty companies including Tata-1mg, Flipkart, Apollo, PharmEasy, for selling medicines online.

- This happened after the All-India Organisation of Chemists and Druggists (AIOCD), a powerful lobby of over 12 lakh pharmacists, threatened to launch a country-wide agitation if the government didn’t act.

What’s in Today’s Article?

- What is the Legislative Framework for e-Pharmacies in India?

- How are e-Pharmacies Competing with Chemist Shops?

- Is Banning e-Pharmacies a Viable Option?

- What Lies Ahead – A hybrid Model of e-Pharmacies and Brick and Mortar Stores?

What is the Legislative Framework for e-Pharmacies in India?

- As of now, no exact rules are in place for E-drug stores in India, and this is a significant inhibitor to the online drug store market in India.

- At present, E-pharmacies in India follow the Drugs and Cosmetics Act 1940, the Drugs and Cosmetics Rules 1945, the Pharmacy Act 1948 and the Indian Medical Act 1956.

- However, the electronic sale of physician-prescribed drugs from online drug store sites is expressed under the IT Act, 2000.

- E-pharmacies are managed by state drug controllers and approvals for E-pharmacies should be given by the Drug Controller General of India (DCGI).

- The MoH&FW in 2018 came out with draft rules to control the online offer of medications and availability of genuine drugs from certifiable online sites.

- But, after being sent to a group of ministers, the proposal was immediately put on hold.

- Since then, multiple court orders and the 172nd Parliamentary Standing Committee report have called for regulating e-pharmacies.

- An administrative structure to oversee/regulate the e-pharmacy sector is necessary when antimicrobial resistance (AMR), criminal and risky movement of drugs, is on the rise.

How are e-Pharmacies Competing with Chemist Shops?

- Flushed with billions of dollars of private equity, e-pharmacies started offering hefty discounts on medicines in a bid to garner more market share.

- e-Pharmacies call themselves facilitate doorstep delivery.

- Companies like PharmEasy are building a supply chain from the ground up by buying out big and small wholesale drug distributors like Ascent Health, Desai Pharma, etc.

- But this aggressive growth is coming at a cost. Since 2015, e-pharmacies have recorded losses year-on-year. For example, Tata-1 Mg posted a loss of ₹146 crore in FY22.

Is Banning e-Pharmacies a Viable Option?

- The demand for online delivery of drugs is burgeoning.

- The year 2020 marked a watershed moment for the growth of e-pharmacies as it saw nearly 8.8 million households using home delivery services during lockdown.

- There is a possibility that some of these businesses will go underground if banned.

What Lies Ahead – A hybrid Model of e-Pharmacies and Brick and Mortar Stores?

- In a climate where drug delivery is driven by consumer sentiments, it is futile to stick to any one way of doing business.

- For acute care and emergency, patients still rely on their neighbourhood pharmacy stores.

- This has led e-pharmacy players to now open capital-intensive brick and mortar stores.

- Stiff competition has forced chemist shops to also offer home delivery options over their own store apps/Whatsapp.

- In an ecosystem that is moving towards a hybrid mode, all eyes are on the government which will have to effectively regulate the new way of doing e-commerce in the drug space.

EDITORIAL – 2 – The case for open, verifiable Forest Cover data

What’s in today’s article?

- Background (Context, FSI’s Report, How is Data computed, etc.)

- Forest Land Encroachment (Meaning, Causes, Loss of Old Forests, Suggestions, etc.)

Background:

- India is one of the few countries to have a scientific system of periodic forest cover assessment in the form of India State of Forest Report.

- India State of Forest Report is an assessment of India’s forest and tree cover.

- It is published every two years by the Forest Survey of India (FSI) under the Ministry of Environment, Forests and Climate Change.

- The first survey was published in 1987.

How is data computed for the Report?

- Data is computed through wall-to-wall mapping of India’s forest cover through remote sensing satellites.

- Three categories of forests are surveyed –

- Very Dense Forests (canopy density over 70%),

- Moderately Dense Forests (40-70%) and Open Forests (10-40%),

- Scrubs (canopy density less than 10%)

- Forest Cover is defined as –

- “An area more than 1 ha in extent and having tree canopy density of 10 percent and above”.

- Tree Cover is defined as –

- “Tree patches outside recorded forest areas exclusive of forest cover and less than the minimum mappable area of one hectare”.

- The data is used in planning and formulation of policies in forest management as well as forestry and agroforestry sectors.

- Since 19.53% in the early 1980s, India’s forest cover has increased to 21.71% in 2021.

- Adding to this a notional 2.91% tree cover estimated in 2021, the country’s total green cover now stands at 24.62%, on paper.

Forest Land Encroachment:

- Encroachment is a term used to describe the advancement of structures, roads, railroads, improved paths, utilities, and other development, into natural areas.

- The National Remote Sensing Agency (NRSA) under the Department of Space estimated India’s forest cover using satellite imagery for periods 1971-1975 and 1980-1982 to report a loss of 2.79%. It declined from 16.89% to 14.10% — in just seven years.

- While reliable data on encroachment is unavailable, government records show that 42,380 sq km — nearly the size of Haryana— of forest land was diverted for non-forest use between 1951 and 1980.

Loss of Old Forests:

- In India, land recorded as forest in revenue records or proclaimed as forest under a forest law is described as Recorded Forest Area.

- Over time, some of these Recorded Forest Areas lost forest cover due to encroachment, diversion, forest fire etc.

- Meanwhile, tree cover improved in many places outside the Recorded Forest Areas due to agro-forestry, orchards etc.

- In 2011, when the FSI furnished data on India’s forest cover inside and outside Recorded Forest Areas, it came to light that nearly one-third of Recorded Forest Areas had no forest at all.

- In other words, almost one-third of India’s old natural forests — over 2.44 lakh sq. km (larger than Uttar Pradesh) or 7.43% of India — were already gone.

Shrinking of Natural Forests:

- Even after extensive plantation by the forest department since the 1990s, dense forests within Recorded Forest Areas added up to cover only 9.96% of India in 2021.

- This loss remains invisible due to the inclusion of commercial plantations, orchards, village homesteads, urban housings etc as dense forests outside Recorded Forest Areas.

- The steady replacement of natural forests with plantations are worrisome for the following reasons –

- First, natural forests have evolved naturally to be diverse and, therefore, support a lot more biodiversity.

- Secondly, plantation forests have trees of the same age, are more susceptible to fire, pests and epidemics, and often act as a barrier to natural forest regeneration.

- Thirdly, natural forests are old and therefore stock a lot more carbon in their body and in the soil.

How to Expand India’s Forest Cover?

- As mentioned earlier, India’s forest cover has increased to 21.71% in 2021.

- Soon after its independence from Britain in 1947, India came out with its first national forest policy in 1952, which had a target of bringing 33 percent of India’s land under forest cover and since then, the target has remained as it is.

- In the present scenario, the possibility of a sizeable increase in forest cover is limited due to the inelasticity of forest land.

- However, the balance of 9 percent can be achieved through taking up plantation/afforestation outside the forests and restocking/plantation in degraded and scrub forests.

- This can be done by –

- Substantially increasing the tree cover outside forests by incentivising and promoting agro-forestry and farm forestry;

- Managing and expanding green spaces in urban and peri-urban areas to enhance citizens’ well-being;

- Plantation of trees outside forests in partnership with local communities, land-owning agencies, and private enterprises;

- Creation, sustainable management and promotion of urban forests (woodlands, gardens, avenue plantations, herbal gardens, etc.) as an integral component of urban habitat planning and development;

- Afforestation/reforestation in public-private partnership (PPP) mode;

- Promotion of urban forests, which include woodlands, wetlands, parks, tree groves, tree garden, plantations in institutional areas, on avenues and around water bodies, etc.

- The Reserve Bank of India (RBI) is preparing a pilot project on QR code-based Coin Vending Machine (QCVM) in collaboration with a few leading banks.

- The pilot will be launched in 12 cities in the country.

- This move is aimed at improving the distribution of coins among the public.

What’s in today’s article?

- News Summary

News Summary: QR code-based Coin Vending Machine

- In February 2023, after announcing the sixth consecutive repo rate hike, RBI governor also put forth RBI’s new pilot project-QR Code based Coin Vending Machine.

What is the project about?

- The vending machines would dispense coins with the requisite amount being debited from the customer’s account using United Payments Interface (UPI) instead of physical tendering of banknotes.

- Customers would be endowed the option of withdrawing coins in required quantities and denominations. The central idea here is to ease the accessibility to coins.

How different is the proposed mechanism for existing conventional machines?

- The conventional machines relied on banknotes for facilitating coin exchanges.

- Further, the proposed machine would eliminate the need for physical tendering of banknotes and their authentication.

What is the rationale behind this move?

- To improve the distribution of coins among the public

- Unlike cash-based traditional Coin Vending Machine, the QCVM would eliminate the need for physical tendering of banknotes and their authentication.

- Customers will also have the option to withdraw coins in the required quantity and denominations.

- This will improve ease of accessibility of coin among public.

- Issue of fake currency in cash-based traditional Coin Vending Machine

- Getting fake currency notes in cash-based traditional Coin vending machines led the Reserve Bank to announce the UPI-based alternative.

- To address the issue of storage place for coins

- The RBI is saddled with a peculiar problem wherein the supply of coins is very high and it takes a lot of storage space.

- However, despite huge demands, these coins are not properly distributed and many places are in the lurch of the coins.

Are coins significant in India’s payment ecosystem?

- Coins in India are issued in denominations of 50 paise, one rupee, two rupees, five rupees, ten rupees and twenty rupees.

- Coins of up to 50 paise are called ‘small coins’ while those of one rupee and above are called rupee coins.

- As per the latest RBI bulletin, the total value of circulation of rupee coins stood at ₹28,857 crore as of December 30, 2022.

- The figure is an increase of 7.2% from the year-ago period.

- Circulation of small coins remained unchanged at ₹743 crore.

Why critics are opposing this move?

- Many critics have opposed the recent decision of RBI to launch QR code-based Coin Vending Machine. They claim that this move is against the digital push of the government.

- At a time, when the government is urging citizens to opt for digital payments, the current step is retrospective in nature.

- However, RBI has defended its move saying that the proposal should not be viewed as a zero-sum game of digital versus cash. The two can easily supplement each other.

- If digitalisation is not solving a particular problem at this given point of time, then it is very much within RBI’s purview to use other means available to achieve its ultimate objective that is to operate the currency system of the country.

Why in news?

- Recently, the National Stock Exchange of India received the final approval from the markets regulator Securities and Exchange Board of India (SEBI) to set up a Social Stock Exchange (SSE).

What’s in today’s article?

- Zero Coupon Zero Principal (ZCZP) Instruments

- News Summary

Zero Coupon Zero Principal (ZCZP) Instruments

- ZCZP are financial instruments that do not pay periodic interest, but are issued at a discount to their face value and mature at par.

- With its zero-coupon, zero-principal structure, it resembles a debt security like a bond.

- When an entity takes a loan by issuing regular debt security like a bond, it has to make interest payments and the principal when the bond matures.

- But with ZCZP instrument, when an entity issues these securities and raises money, it is not a loan but a donation.

- So, the borrowing entity does not have to pay interest—therefore zero coupon—and it does not have to pay the principal (zero principal) either.

News Summary: Social Stock Exchange (SSE)

What is a Social Stock Exchange?

- Background:

- Finance Minister Nirmala Sitharaman, presenting the Union Budget back in 2019, had proposed to initiate steps for creating a stock exchange under the market regulator’s ambit.

- She had argued that it was time to take our capital markets closer to the masses and meet various social welfare objectives to inclusive growth and financial inclusion.

- The proposal was cleared in September 2021.

- About:

- The SSE would function as a separate segment within the existing stock exchange and help social enterprises raise funds from the public through its mechanism.

- It would serve as a medium for enterprises to seek finance for their social initiatives, acquire visibility and provide increased transparency about fund mobilisation and utilisation.

- Retail investors can only invest in securities offered by for-profit social enterprises (SEs) under the Main Board.

- In all other cases, only institutional investors and non-institutional investors can invest in securities issued by SEs.

Who will be eligible to be registered or listed on the SSE?

- Any non-profit organisation (NPO) or for-profit social enterprise (FPSEs) that establishes the primacy of social intent would be recognised as a social enterprise (SE).

- Recognition of social enterprise would make the entity eligible to be registered or listed on the SSE.

- As per the SEBI’s regulation, the enterprises must be serving to:

- eradicate either hunger, poverty, malnutrition and inequality;

- promoting education, employability, equality, empowerment of women and LGBTQIA+ communities; working towards environmental sustainability;

- protection of national heritage and art or bridging the digital divide, among other things.

- At least 67% of their activities must be directed towards attaining the stated objective.

- This is to be established by enumerating that, in the immediately preceding three-year period:

- either 67% of its average revenue came from the eligible activities;

- expenditure (in the same proportion) was incurred towards attaining the objective; or

- the target population constitute 67% of the overall beneficiary base.

- Corporate foundations, political or religious organisations or activities, professional or trade associations, infrastructure and housing companies (except affordable housing) would not be identified as an SE.

- Additionally, non-profit organisations (NPOs) would be deemed ineligible should it be dependent on corporates for more than 50% of its funding.

How do non-profit organisations (NPOs) as well as For-Profit Enterprises (FPEs) raise money?

- NPOs

- NPOs can raise money either through issuance of Zero Coupon Zero Principal (ZCZP) Instruments from private placement or public issue, or donations from mutual funds.

- SEBI had earlier recognised that NPOs by their very nature have primacy of social impact and are non-revenue generating.

- Thus, there was a need to provide NPOs a direct access to securities market for raising funds. Hence, ZCZP instruments were launched.

- Another structured finance product available for NPOs is the Development Impact Bonds.

- Upon the completion of a project and having delivered on pre-agreed social metrices at pre-agreed costs/rates, a grant is made to the NPO.

- The donor who makes the grant upon achieving the social metrics would be referred to as ‘Outcome Funders’.

- Since the payment above is on post facto basis, the NPOs would have to also raise money to finance their operations. This is done by a ‘Risk Funder’.

- It is mandatory that the NPO is registered with the SSE for facilitating the issuance.

- NPOs can raise money either through issuance of Zero Coupon Zero Principal (ZCZP) Instruments from private placement or public issue, or donations from mutual funds.

- FPEs

- It can raise money through:

- issue of equity shares (on main board, SME platform or innovators growth platform of the stock exchange) or

- issuing equity shares to an Alternative Investment Fund including Social Impact Fund or issue of debt instruments.

- For-Profit Enterprises (FPEs) need not register with social stock exchanges before it raises funds through SSE.

- However, it must comply with all provisions of the ICDR Regulations (Issue of Capital and Disclosure Requirements) when raising through the SSE.

- It can raise money through: